When it comes to investing in luxury watches, Rolex is a brand that stands head and shoulders above hundreds of competitors. Rolex watches are known for their timeless designs, unparalleled craftsmanship and remarkable value retention; they are more than just status symbols—they’re coveted assets. However, finding the perfect model to invest in can be a long, winding journey. Not all Rolex models appreciate at the same rate, and choosing the right one requires deeper insight into market trends, rarity, and desirability. It’s not just about selecting a beautiful watch; it’s about identifying the models with the strongest potential for value growth.

To help you on your journey, we’ve curated a list of the 9 best Rolex for investment in 2025, from timeless classics to standout releases, each one a wise pick for collectors and investors alike. Whether you’re starting out or looking to deepen your collection, these Rolex models blend prestige with investment potential.

Key Takeaways From the Blog

- Rolex watches hold strong value due to brand legacy, high demand, exclusivity and market trends.

- Highly sought-after Rolex models include the Daytona, Submariner, GMT-Master, Explorer and Datejust, all known for steady appreciation.

- Rarity, historical significance, material composition and collector demand drive price appreciation in vintage and modern Rolex models.

- Pre-owned Rolex watches often offer higher immediate returns by bypassing depreciation, while new models appreciate over time, especially high-demand pieces like the Daytona and GMT-Master II.

- Watches.io provides real-time analytics, authentication, and secure trading tools, helping investors manage Rolex purchases like financial assets.

Rolex Investment Potential and Key Factors

Evaluating Rolex models for their investment potential requires a close look at the key factors that drive long-term value. Each of these key elements influences a model’s appreciation which helps you pinpoint the best choices that not only look stunning on the wrist but also promise significant future returns. For dedicated Rolex investors, understanding these essentials is a strategic step towards selecting pieces with the highest growth potential.

- Brand Legacy: Rolex’s esteemed reputation for quality and craftsmanship solidifies it as a reliable luxury investment brand.

- Model Demand: Iconic models like the Daytona and Submariner enjoy a rabid following, contributing to their consistent value retention and appreciation.

- Market Trends: Economic shifts and style trends affect prices, so tracking these helps identify models with rising demand.

- Exclusivity: Limited editions and watches tied to significant events or milestones often gain additional value due to their exclusivity and collectability.

Choose a Rolex that aligns with both your personal style and investment goals to maximize both enjoyment and potential returns. While many Rolex models offer promising growth, they also provide lasting daily appeal, making them a valuable addition to any collection.

Explore our top Rolex models for investment in 2025, each selected for their historical performance, demand, and appreciation potential.

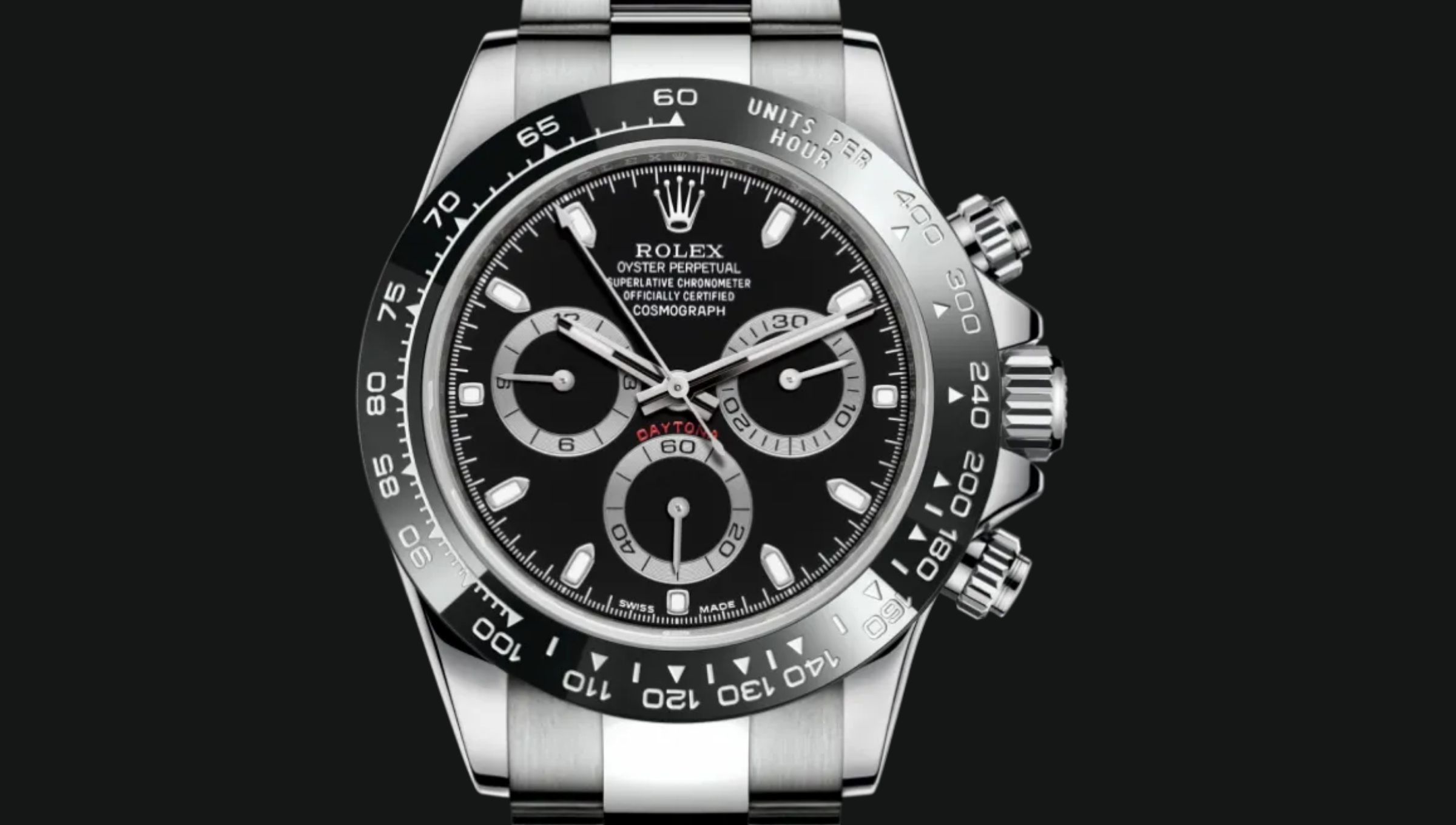

1. Rolex Cosmograph Daytona

The Rolex Cosmograph Daytona is a legendary model with deep roots in motor racing and a rich investment history. Launched in 1963 for race car drivers, it features a precise chronograph and tachymeter scale. The Daytona gained iconic status in 2017 when actor Paul Newman’s personal Daytona sold for a record-breaking $17.8 million, boosting its investment appeal and cementing its legendary status.

Today, the Daytona continues to attract investors because of its limited production, unique design, and deep historical significance. Despite market fluctuations, the Daytona maintains high value, with many models trading at substantial premiums over retail. It saw rapid price fluctuations and hit peak pricing in mid-2022, and demand has remained very strong since. The Daytona’s exclusivity, resale value, and timeless appeal make it a premier choice for investors seeking a Rolex with lasting appreciation potential.

2. Rolex Submariner

The Rolex Submariner is renowned for its durability and ageless design, making it a valuable choice for collectors and investors alike. Released in 1953, it was the world’s first waterproof watch to reach depths of 100 meters. With its robust construction, rotating bezel, and luminous markers, the Submariner quickly became the standard for dive watches and a solid investment option.

According to a Morgan Stanley report, eight key Submariner references delivered a 24.2% return on investment, highlighting its consistent market performance.

In the debate of Rolex Starbucks vs Kermit, both models exemplify the Submariner’s legacy, offering collectors a choice between vintage exclusivity and modern advancements.

Vintage and limited-edition models, like the “Red Sub” and “COMEX” editions, often command significant premiums due to their rarity and historical significance. For investors, the Submariner combines timeless style with solid investment potential, making it a highly reliable Rolex model for those seeking appreciation and legacy.

3. Rolex GMT-Master & Rolex GMT-Master II

The Rolex GMT-Master and GMT-Master II stand out as two of the preeminent options for buy-and-hold collectors and speculative investors alike. Originally designed in the 1950s for Pan Am pilots, the GMT-Master gained instant popularity for its functionality and pioneering two-time-zone display, making it an essential tool for international travelers. Over the years both models have evolved, with the GMT-Master II (launched in the 1980s) incorporating a quick-set hour hand that improved technical performance while preserving the classic aesthetic that collectors love.

What truly makes the GMT-Master series ideal for investment is its enduring appeal and steady demand among enthusiasts. Vintage GMT-Master ref. 1675 models with “Pepsi” (red and blue) or “Coke” (black and red) bezels are especially coveted, with prices climbing in the secondary market due to their rarity and historical charm. While the “Coke” bezel is typically associated with the later GMT-Master II ref. 16760, some customized ref. 1675 models may feature it, adding a unique twist for collectors.

Key vintage references include the “Fat Lady” GMT-Master II Ref. 16760, known for its thicker case, and the classic GMT-Master II ref. 16710 , which offers the sought-after “Pepsi” and “Coke” bezel colorways. Among modern editions, the Rolex 116710LN is notable for being the only GMT-Master II with green accents as well as for introducing the durable ceramic “Cerachrom” bezel, both unique features that have made it a future collectible with a strong appreciation potential. Similarly, the “Batman” (blue and black) and “Pepsi” ceramic bezel models continue to see high demand and limited availability, enhancing their investment appeal.

With a blend of vintage charm and modern desirability, the GMT-Master series offers compelling options for those seeking both style and investment growth, ensuring these models remain favorites among collectors.

4. Rolex Explorer & Rolex Explorer II

The Rolex Explorer is cherished for its durable design and iconic association with the 1953 Mount Everest expedition. With a minimalist aesthetic and robust construction, the Explorer is popular among collectors seeking a model with strong historical ties and reliable investment potential.

Recently, Rolex reintroduced the classic 36mm case size in ref. 124270 and a two-tone version in ref. 124273, reigniting interest in the model. While many appreciate the compact 36mm size, others favor the unique 39mm ref. 214270, the only Explorer produced in this size. Both versions are currently available at accessible acquisition prices that are showing strong signs of appreciation.

Vintage references like the ref. 14270 have also seen steady price growth due to their historical significance and collector demand, making the Explorer a strong investment choice.

Rolex Explorer II: Launched in 1971, the Rolex Explorer II builds on the Explorer’s adventurous spirit with unique features for spelunkers and explorers, such as a 24-hour hand to differentiate day and night. Vintage models like the ref. 16550, also known as the “Freccione” or “Steve McQueen,” are highly admired for their distinctive design and historical relevance.

In 2021, Rolex celebrated the Explorer II’s 50th anniversary with the updated ref. 226570, closely resembling its predecessor ref. 216570. This similarity has heightened the investment appeal of the 216570 due to its lower price relative to the current model. Earlier references like the ref. 16570, with a compact 40mm case and unique features are also prized by collectors and offer excellent appreciation potential, balancing vintage appeal with functional durability.

5. Rolex Datejust

The Rolex Datejust is a versatile model with enduring collector interest, known for its classic design and consistent resale value. With a reliable track record for market stability and gradual appreciation, Datejust offers options in various styles that appeal to a range of investment strategies. It is available in various sizes, materials, and styles from stainless steel and gold models to diamond-set editions, with options ranging from contemporary to vintage pieces.

Among its most iconic versions, the two-tone 36mm Datejust in stainless steel and yellow gold became widely popular in the 1980s and is considered an emblematic piece in Rolex’s storied design legacy. This classic model, which typically features a fluted bezel, remains relatively affordable on the pre-owned market, providing an undervalued opportunity for investors.

Key vintage references include:

- ref.1601

- ref.16013

- ref.16233, all available between $6,000 to $10,000 range on the secondary market.

For those seeking a more modern Datejust, the ref. 116233 maintains the classic two-tone look but adds updates like a solid-link bracelet and thicker lugs, echoing the style of current models while being priced several thousand dollars lower on the secondary market. With ongoing elevated demand and appreciation potential, the Rolex Datejust remains a cornerstone for collectors and a smart addition to any investment portfolio.

6. Rolex Yacht-Master

The Rolex Yacht-Master combines luxury and durability, appealing to collectors with its nautical-inspired design. Released in 1992, it features a bidirectional bezel and highly legible dial, making it a sought-after choice for those looking to balance elegance with practical investment potential.

Certain variants, such as the Yacht-Master 40 in Everose gold and Rolesium (steel and platinum) editions, have shown strong appreciation potential due to their refined materials and limited availability. For women and collectors of smaller watches, the Lady Yacht-Master (ref. 169622)—the only women’s sports model Rolex has produced—presents an undervalued opportunity, with its rarity expected to drive up prices over time.

With its blend of luxury, sportiness, and limited-edition models, the Yacht-Master is a compelling investment choice. As demand for exclusive sports watches grows, this model offers significant potential for creating new value within a diversified luxury watch portfolio.

7. Rolex Day Date

The Rolex Day-Date, or “President,” crafted from precious metals for a truly luxurious look, stands out as one of Rolex’s most prestigious models.. Exclusively made in 18k yellow, white, Everose gold, and platinum, the Day-Date is a high-value investment for collectors seeking timeless appeal and high appreciation potential.

As demand for gold watches grows amid economic uncertainty, the Day-Date collection has gained renewed popularity. Classic references like the ref. 1803 and ref. 18238 are especially prized for their iconic design and precious metal composition, making them strong choices for value retention. Modern models such as the ref. 118238 feature updates like a solid-link 18k gold bracelet and thicker lugs. Currently priced around $23,000 on the secondary market, the ref. 118238 offers a more accessible entry point relative to newer models, with potential for value growth as gold prices remain high.

Another noteworthy option is the Rolex Day-Date II (produced from 2008 to 2015), which features a larger 41mm case and offers a bold, sporty take on the classic Day-Date. With limited production and a unique design, the Day-Date II presents an attractive investment opportunity for collectors seeking rarity and distinctive style within the Day-Date lineup.

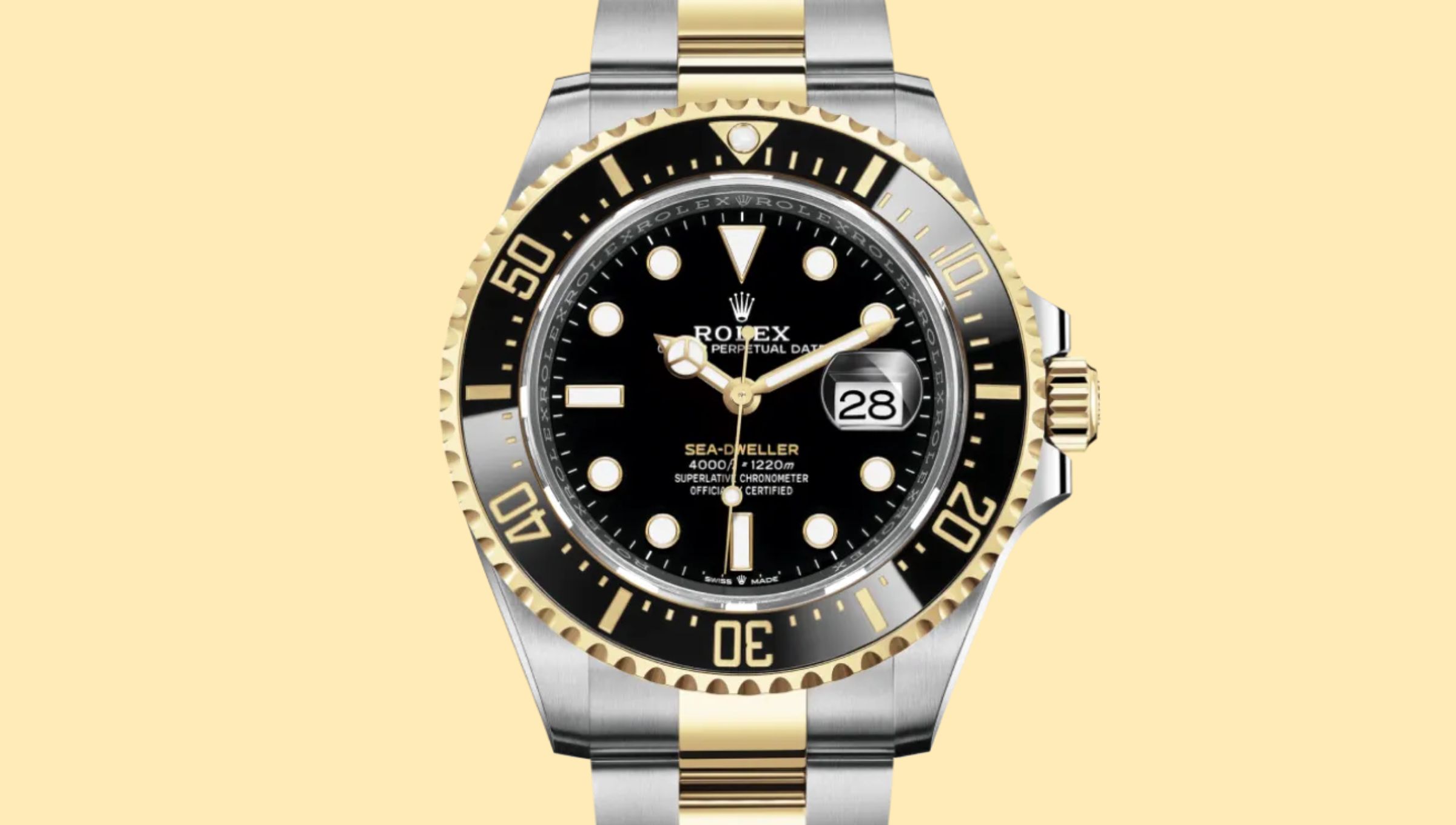

8. Rolex Sea-Dweller

The Rolex Sea-Dweller is a durable dive watch designed for high performance and advanced water resistance. Known for its signature helium escape valve, the Sea-Dweller is a top choice for collectors and sports enthusiasts seeking a valuable investment with unique functionality. Although it offers greater depth capabilities than the Submariner, the Sea-Dweller remains relatively undervalued on the secondary market, presenting an attractive investment opportunity.

Among its most notable vintage models, the ref. 1665 stands out as the first Sea-Dweller with a helium escape valve. Collectors highly value variants like the Double Red (DRSD) and the “Great White,” prized for their historical significance and unique features. Transitional models like ref. 16660 “Triple Six” and ref. 16600 combine classic Sea-Dweller styling with modern durability and are often priced similarly to entry-level Submariners.

The ref. 116600 (2014–2017) represents the last 40mm Sea-Dweller without a Cyclops lens and the first with a ceramic bezel, making it a rare find due to its short production run. Given the growing market interest in exclusive sports models, the Sea-Dweller is positioned for strong appreciation potential, offering both selectivity and long-term value within the Rolex lineup.

9. Rolex Air-King

The Rolex Air-King, crafted in honor of British Royal Air Force pilots, holds special historical significance in Rolex’s lineup. Known for its accessible price and classic design, the Air-King remains a valuable entry point for collectors and investors. Vintage 34mm models, such as the Rolex 5500 (produced from 1958 to 1989), offer some of the best value in Rolex collecting; prices for these start around $4,000 to $5,000 on the secondary market.

For those seeking a more modern look, the ref. 14010 features distinctive updates like a sapphire crystal and a unique engine-turned-bezel, which enhances its collector appeal. Additionally, discontinued 6-digit references like the ref. 114200 and ref. 114234 come with a chronometer-certified movement, solid-link bracelet, and various dial colors—qualities that are drawing increasing attention. As interest in the Air-King collection grows, these models present promising investment opportunities among the Rolex lineup.

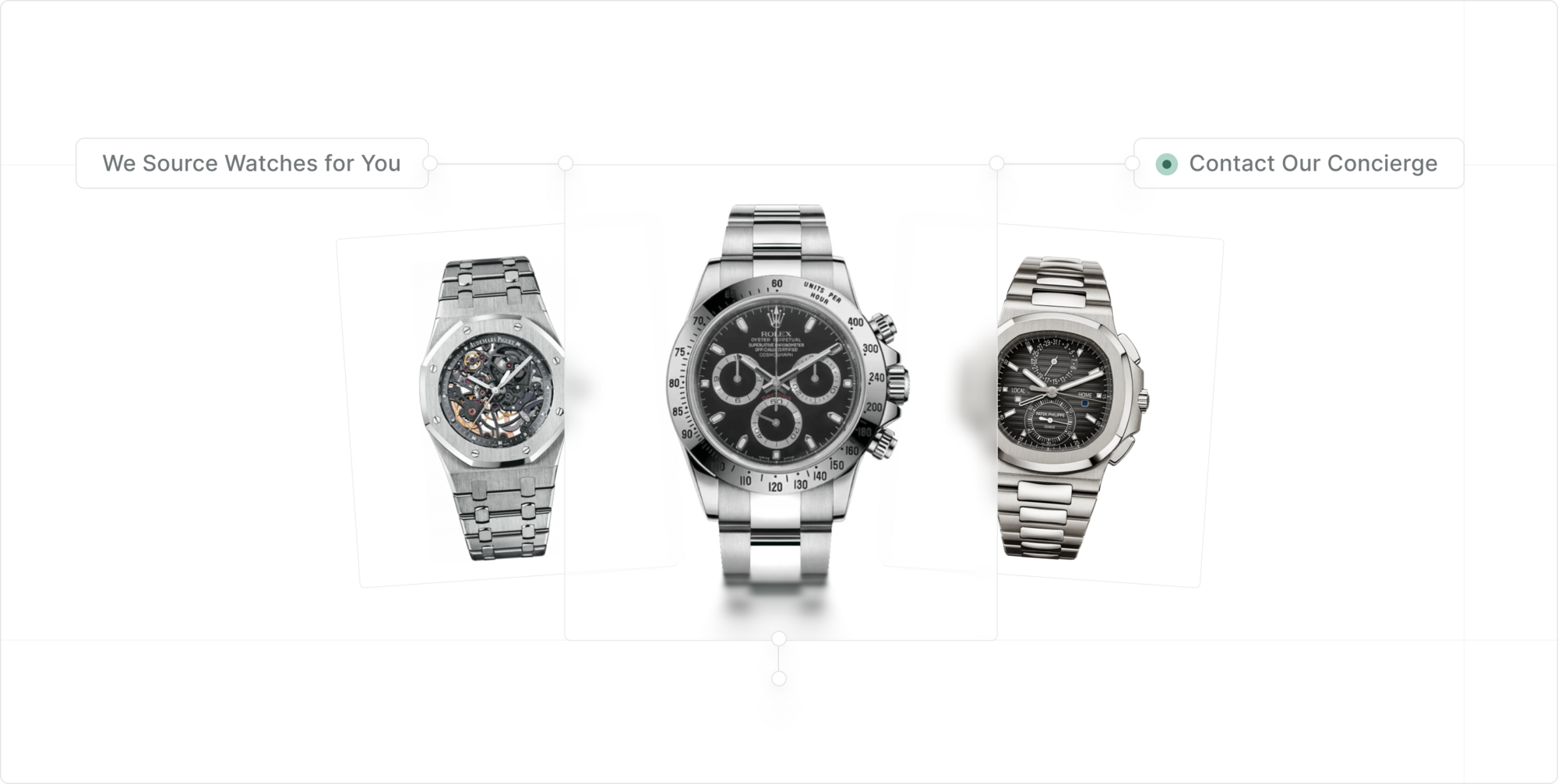

How Watches.io Helps You Make Smart Rolex Investments

Watches.io offers a data-driven platform for Rolex investments consisting of real-time analytics, value tracking, and secure purchasing. Our marketplace allows investors to manage collections like a stock portfolio, combining reliable watch inspection, authentication, and personalized support to achieve a streamlined investment experience.

Each watch undergoes rigorous inspection and authentication, ensuring quality and trust in every purchase. Watches.io’s Concierge service offers personalized assistance, and our secure storage vault allows offsite storage, high-frequency trading, and integration with DeFi tools.

With real-time data, authenticated listings, and tailored customer support, Watches.io enables investors to make strategic Rolex investments that align with their financial goals.

Pre-owned or New Rolex: Which Holds the Best Investment Value?

Pre-owned or new Rolex, each option has distinct investment advantages.

Pre-owned Rolex: Pre-owned Rolex watches often hold strong investment appeal because they bypass the initial depreciation seen with new watches. Vintage models and discontinued references, such as the Submariner ref. 1680 or Day-Date ref. 1803, are highly sought-after on the secondary market. Their scarcity and historical significance make them prime candidates for long-term appreciation as collector demand continues to grow.

New Rolex: New Rolex models, especially high-demand ones like the Daytona, Submariner and GMT-Master II, may appreciate quickly due to limited availability and lengthy waitlists. Buyers who secure these models at retail often see instant value increases on the secondary market. However, new models have higher entry costs and typically require a longer holding period to realize substantial gains.

Investment Summary: Pre-owned Rolex models typically offer higher immediate returns by bypassing initial depreciation. New Rolex models can also appreciate well, particularly for in-demand references, but they may require patience for significant growth.

Explore Watches.io’s Marketplace for the Best Rolex Watches for Investment

To find the best investment-worthy Rolex watches, visit Watches.io’s marketplace, where verified listings offer transparency and security in every purchase. With insights into market appreciation and resale value, Watches.io allows investors to explore options tailored to their personal investment strategy and timeline. Visit the marketplace today to discover the best Rolex watches with promising growth potential and secure your next valuable timepiece.